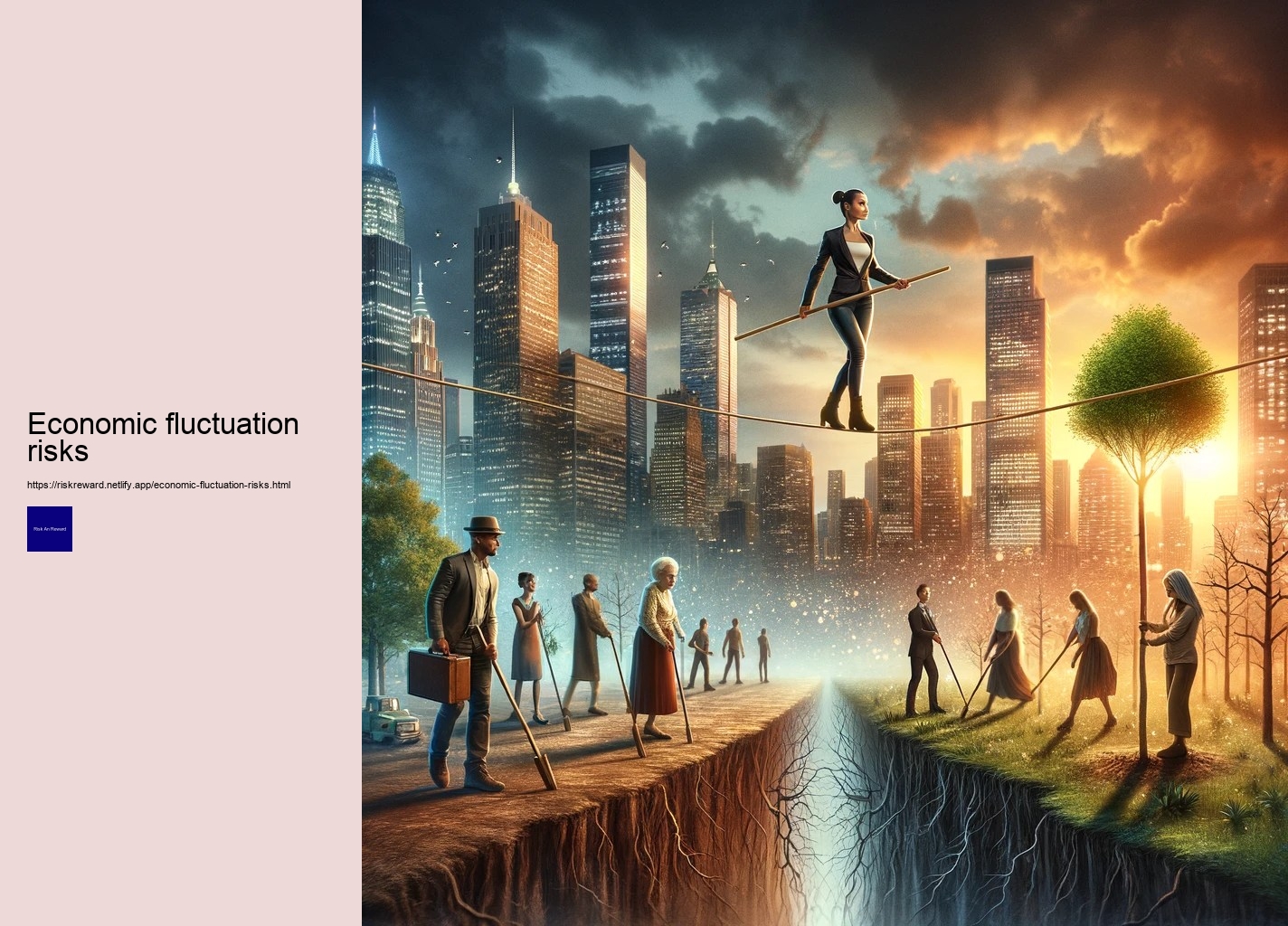

Inflation risk refers to the possibility that prices of goods and services will increase over time, decreasing the value of money held by investors. This type of risk can be especially concerning for those who rely heavily on fixed-income investments, such as bonds. Interest rate risk is also associated with inflation risk, as changes in interest rates can cause bond values to drop suddenly. Trading Journal

Volatility risk occurs when stock prices experience extreme fluctuations in a short period of time. Investors must be aware of this type of risk and take steps to protect their portfolio against sudden losses due to market volatility. Exchange rate risk is related to foreign exchange markets, where currencies are traded back and forth across borders. Unexpected changes in exchange rates can cause significant losses if not managed carefully. Stop-loss Orders

Political uncertainty is another form of economic fluctuation risk that investors should keep an eye out for. Changes in government policies or unexpected political events can have drastic effects on financial markets, making it difficult to predict what will happen next. Finally, there is always the chance that natural disasters or other unforeseen events could have an impact on the global economy with unpredictable consequences.

Economic fluctuation risks - Oneup Trader

- Risk-Reward Ratio

- Comparing AI Assistants with Human Assistants

- The5ers

It is essential for investors to be aware of these types of economic fluctuation risks so they can make informed decisions about how best to manage their portfolios in order to minimize losses and maximize returns over time.